Cost of Living in Frankfurt Dec 2022. Prices in Frankfurt

Table of Content

- Typical home price in West Virginia: $137,286 (32% of typical U.S. price)

- Canada Real Estate Market Trends for All Property Types

- best last-minute Christmas gift ideas you can get in time for 2022

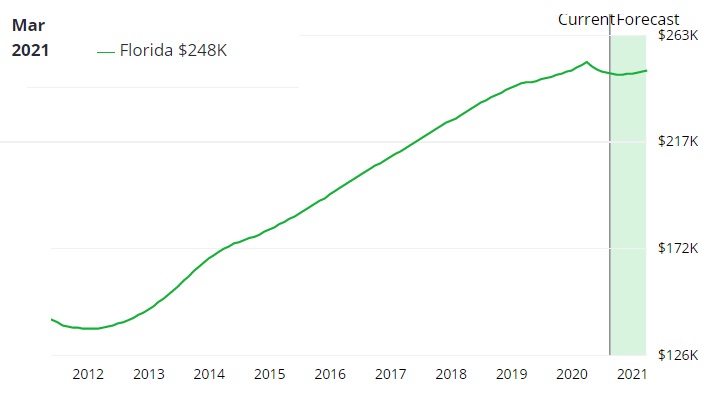

- Current Home Price Trends & Forecast Until August 2023

- Typical home price in Maine: $360,836 (84% of typical U.S. price)

- Reports and Plans

- Typical home price in Massachusetts: $611,819 (143% of typical U.S. price)

As a result, year-over-year house sales have fallen in recent months. A record 79 percent of respondents in a Fannie Mae study on homebuyer sentiment indicated it's a poor time to buy a home. The economic jolt caused by rising mortgage rates is continuing to eat away at some of the gains that were earned in the spring of 2022. Zillow projects typical U.S. home values to fall 0.6% from October 2022 to January 2023, before recovering and posting 0.8% growth by the end of October 2023. The national Zillow Home Value Index, which rose 11.9% in the 12 months ending in October 2022, is expected to grow by just 0.8% over the next 12 months. The Toronto housing market has seen a collapse in sales volume as buyers retreat from one of Canada’s most expensive housing markets.

Many prospective buyers, especially those with limited financial resources, are eager to hear whether and when home prices will become more accessible. While this may appear to be an oversimplification, this is how markets operate. The quarterly housing outlook pulse poll conducted by Freddie Mac assesses public attitudes on housing-related problems.

Typical home price in West Virginia: $137,286 (32% of typical U.S. price)

With mortgage rates, well above 5 percent, refinancing activity, which was brisk during the epidemic when rates were at an all-time low, has dwindled by more than 70 percent compared to last year. Zillow’s forecast for existing home sales in 2022 was revised down slightly as leading indicators point to a continued slowing in the housing market in the near term. Expectations for continued weakness in home sales volume led Zillow’s one-year home value forecast to be revised downward in November. In 2019, residential real estate transactions in Canada reached 486,800, a 6.2% increase from a five-year low recorded in 2018.

The state is notorious for its high housing costs, especially in the San Francisco and Los Angeles areas. Perhaps in part due to these high costs, California also has the nation's highest level of homelessness. The typical home in the state costs $760,800 and is 1,625 square feet. Even with a median income 6% below the median for the whole country, average mortgage payments don't cost much. This resulted in one of the biggest seller's markets in history, although that may be changing as mortgage rates increase and housing supply expands. Now, let's take a deeper dive into what average house prices are like across the country.

Canada Real Estate Market Trends for All Property Types

A time when normal seasonal trends typically favor home buyers over sellers, thus buyers hoping for the usual break in 2020 were likely disappointed. Understanding this backdrop will be key to evaluating the data as it comes in for 2021 as we expect the housing market to settle into a much more normal pattern than the wild swings we saw in 2020. Year over year trends will need to be understood in the context of the unusual 2020 base year.

In recent history, that outlier was the Great Recession, which caused both median and mean home prices to drop. The median home price in the U.S. increased by 416% from 1980 to 2020. Newly listed homes,” will be more numerous which will help power the expected increases in home sales. 7.6% above 2019, after a seeing near record high boost in the summer and early fall, but beginning to decelerate into the holidays. From there, we expect price gains to ease somewhat in 2021 and end 5.7% above 2020 levels, decelerating steadily through the spring and summer, and then gradually reaccelerating toward the end of the year.

best last-minute Christmas gift ideas you can get in time for 2022

New Brunswick saw its average home price increase by 6% year-over-year to $266,204, while Nova Scotia's average home price increased 10% year-over-year to $385,756. PEI's average home sold price declined by 3% year-over-year to $357,521. Mortgage payments are high despite Oregon residents earning 13% more than the national average. Incomes are 22% less than the national median, but the median house price is less than half of the typical U.S. price. Homes in Connecticut cost less than the typical price across the country while the median income in the state beats the U.S. median by 20%.

The Ascent also has a mortgage calculator that can help you figure out mortgage payments and house affordability calculator to help you determine how much real estate you can afford. Wyoming has less-expensive homes than the norm, and earnings are only 4% lower than the median income. It still doesn't manage to pass the 28% rule, even though it's fairly close. The typical Nevada resident has a tough time paying for a home because of high prices.

Current Home Price Trends & Forecast Until August 2023

Earnings don't quite outweigh the expensive home prices, so mortgages take up a significant chunk of what homeowners make. Massachusetts has some of the country's most expensive housing costs. Owning a home is challenging in this state, even with a median income that beats the national median by 28%. Residents of Illinois generally don't need to spend too much of their salaries on their mortgages. The typical house price is 37% lower than the countrywide number, and incomes are 9% above the national median. According to the Federal Reserve Bank of St. Louis, the median home sales price is $428,700.

Among these is a shelter component that includes both rental costs and the consumption value of owner-occupied housing, in addition to other forms of lodging such as hotels. Shelter makes up nearly a third of the basket for CPI inflation, and 40 percent of the basket for core CPI that excludes the volatile food and energy components. As a result, even small increases in rent and home prices can, in principle, have noticeable effects on overall inflation. Increasing interest rates will almost certainly have a greater impact on the national housing market in 2022 than any other factor. While sellers remain in an advantageous position, price stability and the continuation of competitive interest rates may provide some much-needed relief to buyers this year.

West Virginia, which has the lowest typical-house cost, also has the highest homeownership rate, with 79.6% of residents owning their own home. We expect the momentum of home price growth to slow as more sellers come to market and mortgage rates settle into a sideways pattern and eventually begin to turn higher. West Virginia boasts the country's lowest housing costs and its highest rates of homeownership.

The average home sold price in the GTA was $1,089,428 for October 2022, representing a decrease of 6% year-over-year. GTA home sales are down 49% year-over-year, with 4,961 transactions in October. While Texas is a popular place to live, homes still cost less than what they do in the rest of the country. The median income is 1% above the U.S. median, so the average mortgage payment still leaves homeowners with plenty of money left over.

Comments

Post a Comment